A Global Currency for a Global Business

Adoption and mainstream use of digital currencies continues to ramp up with more than 992 million cryptocurrency users forecasted by 2028. The rosy outlook carries over to market size with Statista forecasting the cryptocurrency market to value at $4.81 billion by 2030 and a CAGR of 17%. Cryptocurrency as practical tender may be still under debate but for travel businesses, accepting cryptocurrencies, such as BITCOIN and ETHER (the currency based on the Ethereum Network), can open up untapped markets and give brands a significant competitive edge in the marketplace. Cryptocurrency adoption spans internationally and a global business like travel would see distinct benefits by accepting a global currency. For smaller and midsize travel operations, setting up payment systems for BITCOIN and ETHER can be cumbersome and require extensive overhaul of current payment platforms but technology can provide an easy to implement solution that delivers safe and secure cryptocurrency payment options to travel clients, potentially expanding the brands demographic reach and increasing transactions.

Accept Cryptocurrencies Easily and Securely

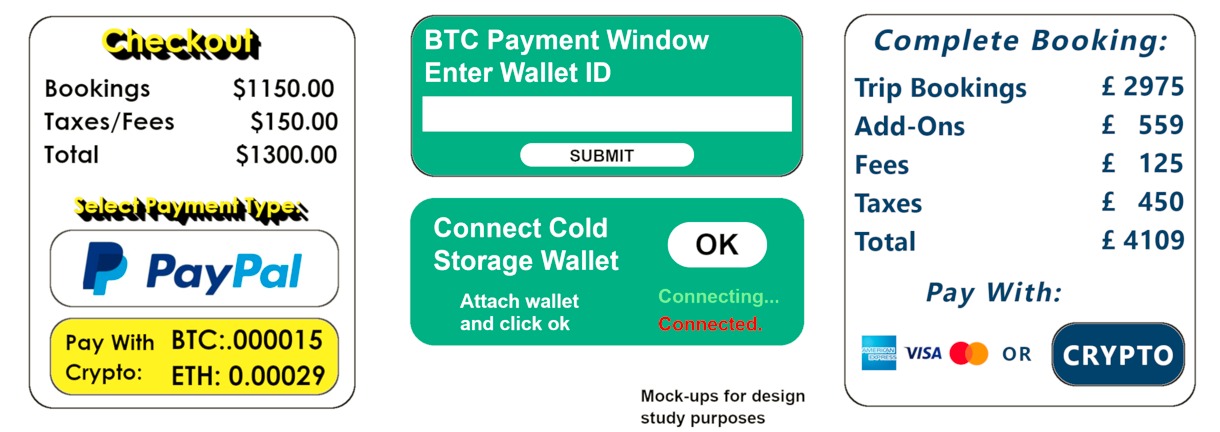

Introducing TripReMIT, a lightweight module that delivers cryptocurrency payment options to travel consumers. TripReMIT is the ideal solution for small and midsize travel businesses that want to tap the increasing number of users of digital currencies such as BITCOIN and ETHER. TripReMIT is completely modular and is deployed to fit any platform stylization and color schemes. TripReMIT offers the following features to travel businesses:

- Displays basket value in BITCOIN and ETHER directly on the payment page

- Allows travel clients to make cryptocurrency payments in just a few clicks

- Uses real time market pricing to establish conversions

- Payment buttons and displays are fully style integrated into the home platform

- Customizable reporting and notifications on transactions and completions

- Cold storage wallet compatible

- Layered security and protocols for increased integrity and stability

Fully featured and compact, TripReMIT is a useful addition to the current portfolio of payment options and utilizes the latest in infrastructure and modules to deliver fast, safe and efficient cryptocurrency payment process and reporting.

TripReMIT is Designed for Travel Businesses

Selling goods and services online is an uphill battle for merchants and unfortunately, the statistics for cart abandonment are astronomical. As recently as July 2024, a survey from Oberlo indicated shopping cart abandonment at 73.94%. Almost three quarters of customers walk away from transactions and for travel businesses, cart abandonment can have greater negative effects on profitability. Early adopters of cryptocurrencies are enthusiastic to transact within the realm of digital assets which could positively influence their final purchasing decision. TripReMIT delivers added payment convenience to travel clients, potentially reducing walkaways and cart abandonment. Travel brands that offer cryptocurrency as a payment option could potentially see increases in business from consumers who spend exclusively in digital currency. In a highly competitive market place, the addition of a cryptocurrency payment option can be that added edge for brands that makes them stand out in a crowded industry.

TripReMIT Helps Travel Brands Expand Reach

Demand and adoption of cryptocurrencies continues to expand into the foreseeable future and a demographic with almost a billion people suggests strong and durable interest in digital assets such as BITCOIN and ETHER. Global businesses, such as travel, could see significant benefits by offering cryptocurrency payment options as mainstream use of digital assets continues to increase. TripReMIT is a simple and compact technology that easily gives small and midsize travel businesses the ability to accept digital assets such as BITCOIN and ETHER. Fully scalable and customizable, TripReMIT works seamlessly on existing platforms and delivers safe and secure cryptocurrency payments from travel clients to the travel business.